The Ghana Revenue Authority (GRA) plans to license banks in the country to accept the payment of taxes, as part of efforts to make the payment of taxes less stressful for taxpayers while also helping to meet its revenue target, according to the Ag. Commissioner General of GRA, Rev. Ammishaddai Owusu-Amoah.

“This will allow tax officials to continue to carry out their tax duties and mobilize revenue which is our mandate,” he said, adding that it will bring convenience into tax payment as taxpayers will not have to physically go to GRA offices to pay taxes.

This development comes as the tax authority declared GH¢43.9billion revenue collection for 2019 representing revenue growth of 16.6percent and exceeding its revised target by 4.4percent.

Out of the tax collected, total Domestic Taxes amounted to GH¢31.9billion as against a target of GH¢29.8billion representing 30.4percent increase as compared to the previous year’s domestic collection.

Domestic Direct Taxes increased by 31.2percent to GH¢21.8billion from a target of GH¢19.9billion as against the previous year’s collection. Domestic Indirect Taxes had a target of GH¢9.9billion and the actual collection of GH¢10.1 billion was realized bringing an increase of 28.6percent over the previous year’s figure.

However, Customs missed its revenue target of GH¢12.2billion by one percent as it recorded GH¢12.1billion. Compared to the previous year’s collection, there was a decline of 8.8percent.

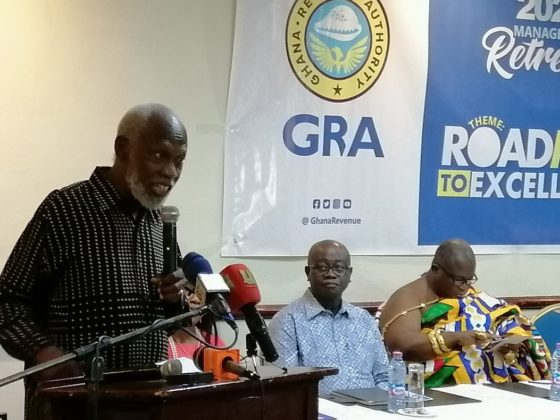

Rev. Owusu-Amoah, while commending staff of the Authority at the annual ‘Management Retreat,’ in Kumasi, attributed the performance to several factors. This includes the upward self-assessment figures and payment of the same by taxpayers, vigorous and issue-based audits, especially in the petroleum sector.

He also mentioned massive debt collection exercises undertaken by the Authority, rigorous examination of imports, enforcement of Excise Tax Stamp and the introduction of the Tax Stamp Authenticator among others.

He said despite being given a tax revenue target of GH¢47billion for the year, 2020, “we have challenged ourselves to collect GH¢55.02billion,” which represents 25.2percent growth over the previous year’s collection. In this regard, GRA expects to collect Domestic Direct Taxes of GH¢26.3billion and Indirect Domestic Taxes of GH¢13.2billion while setting a target of GH¢15.5billion for Customs.

Outlining the strategies adopted by the GRA for the year, the Ag. Commissioner-General said the Authority will continue to undertake a strong digitization drive as part of the transformation agenda.

To this end, he announced that “in the year, we will automate the payment of Value Added Tax (VAT). This will involve linking teller systems VAT registered businesses to a centralized database to ensure that VAT collected is credited to the Authority in real-time.”

He also noted that all the second modules in the second phase of the Integrated Tax Application and Processing System (ITaPS) will be rolled out in, and the introduction of the payment of Vehicle Income Tax and Tax Stamp payment by mobile money.

In line with the theme for the 2020 Management Retreat, which was ‘Roadmap to Excellence’, the Commissioner-General charged staff of GRA to endeavor to further improve the services they offer to the public.

The board chairman of GRA, Prof. Stephen Adei, said the focus of the board is on how to create the conditions that will enable the Authority to work effectively, including acquiring technology for the work. He said they have already gone through the first stage of approval from the Public Procurement Authority (PPA) for shortlisted companies to supply the needed technology, especially for the Domestic Tax office.

“We want to expedite getting you the tools,” he added. He noted among other things that the board exists to support the work of the Authority including ensuring that the revenue leakages are addressed. He clarified his first public statement as the board chairman of GRA saying his comments were meant to stress that in the tax laws of the country there are no protocols except for some exemptions, which includes the President, Vice President, and others.

“Therefore, you as staff cannot say that I was asked to do this. If it is illegal and you do it you will be held responsible,” he stated.

Board Chairman of GRA, Prof. Stephen Adei, addressing the gathering at Management Retreat, in Kumasi.

Source: B&FT Online