The Bank of Ghana (BoG) has stated that it is not processing any application for a fresh banking licence to new entrants into the banking sector.

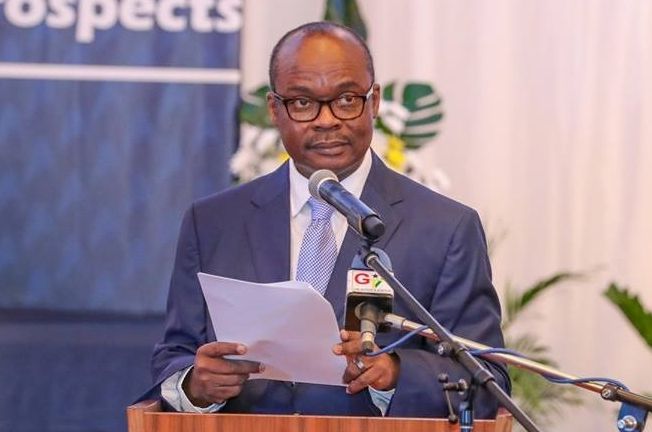

The Governor of the BoG, Dr Ernest Addison, who stated this, was content that the banking sector reforms that cut the number of banks from 33 to 23 had made the banking sector more resilient to shocks.

Speaking to the Daily Graphic in Accra, he said the central bank had not received any fresh applications for new banking licences in the last few months.

He was confident that the few banks that currently operated in the country remained “well-capitalised, solvent, liquid, efficient and profitable, with improved financial soundness indicators”.

There had been concerns in some circles that the central bank was processing fresh applications for banking licences two years after the financial sector clean-up.

But Dr Addison said: “We have a framework that we are working with. It is an open and liberal financial sector and if you meet the minimum capital of GH¢400 million, we will license you.”

At a Monetary Policy Committee news conference last Friday, Dr Addison, who had given an update of the banking sector reforms, had said the financial sector was strong and liquid, even with just 23 banks, suggesting that “the fewer, the merrier”.

“At the start of the reforms in August 2017, total assets were GH¢89.1 billion for a sector that had [36] banks, and two years after the reform process started, total assets had increased to GH¢115.2 billion as of the end of August 2019, even with 23 banks.

“In the same direction, total deposits have improved from GH¢55.7 billion to GH¢76.0 billion over the same comparative period, reflecting a stronger deposit base owing to more trust and confidence in the banking sector, with fewer but stronger banks,” he said.

Dr Addison said there had been a marked improvement in banks’ performance, which reflected a positive impact of the recent reforms.

“Banks are beginning to focus on their core mandate of financial intermediation based on the strong capital base after recapitalisation,” he said.

He said the asset quality had improved, with a decline in the non-performing loans (NPL) ratio from 21.3 percent in August 2018 to 17.8 percent in August 2019.

“The NPL ratio is trending in the right direction and is expected to be sustained by continued implementation of the NPL write-off policy, intensified loan recovery efforts and stronger credit risk management practices,” he added.

Dr Addison also emphasised that the cleaning up of the financial sector was over.

“All the problem institutions in the sector have been taken out and we think that should end the exercise,” he said.

On the issue of rural banks, he said that would be dealt with by the Apex Bank, with support from the BoG.

“We will deal with the Apex Bank to see how best to deal with some of the problem institutions in that sector,” he said.

Weaker banks out

Expatiating on the reforms, the governor said: “Largely, the reforms that we intended to put in place over the last two years have been very successful and completed and most of the weaker institutions that were driving up operational costs and making lending rates high are out of the system.”

“If you take the microfinance segment, for instance, these were the institutions that were setting up high deposit rates, despite their inefficiencies. I understand the deposit rate in that segment has now collapsed from 30 percent to around 15 percent, which is what we expected,” he added.

Dr Addison said the central bank expected the reduction in the deposit rate to have a knock-down effect on all lending and interest rates in the financial sector.

Source: Graphic Online