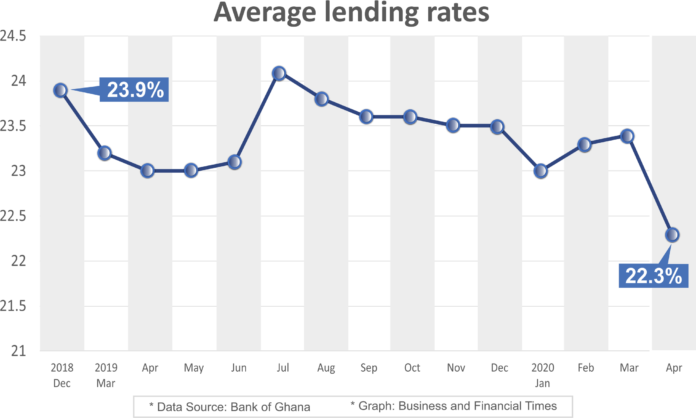

After staying virtually flat for about a year and a half, the average lending rate of banks has started to show signs of decline in April after the Bank of Ghana reduced the monetary policy rate the month before.

The Summary of Economic and Financial data (May 2020) published by the Bank of Ghana has shown that average lending rate has finally moved out of its comfort zone to a step downward. Prior to recording 22.38 percent in April, the average lending rate has since the past 17 months (December 2018) not come below 23 percent.

The decline, though marginal, offers a glimpse of hope for the private sector that lending rates may come down in future if economic conditions make it possible for the Monetary Policy Committee (MPC) of the central bank to further cut the policy rate after it reduced it by 150 basis points to 14.5 percent in March, following the outbreak of the coronavirus in the country.

The MPC said the decision was basically made to allow banks reduce their lending rates to aid the private sector – which has been the hardest hit by the impact of the coronavirus – have access to loans at reasonable rates to inject into their businesses so they can recover faster.

Banks, on the other hand, also responded by indicating they will reduce their lending rates by 2 percentage points. However, the data show that averagely banks were only able to reduce it by 1.1 percentage points.

Commenting on this, banking consultant Dr. Richmond Atuahene says the high operational cost banks are incurring in this pandemic period will make it difficult for them to further reduce their lending rates, despite their pledge to do so by 200 basis points.

“Try to look at the situation very well and see whether the banks have actually dropped their lending rates by 2 percent. It [the 150 basis points cut in policy rate] cannot reflect immediately because of operational cost that has gone up due to the pandemic. And when operational cost goes up, the banks would not like to reduce their lending rates, otherwise their interest income will reduce and cannot cover their operational cost.

“Secondly, their non-performing loans will also go up. And once the non-performing loans go up, the interest income will come down. So, it is not possible for banks to absorb all those expenses now,” he told the B&FT in an interview.

Beyond the promise of making lending affordable for businesses, commercial banks in collaboration with the Bank of Ghana have arranged a GH¢3billion facility for lending to critical industries to encourage local production in a bid to move the economy from import dependency to becoming more self-sufficient.

Thus, the Managing Director of the Republic Bank, Farid Antar – in an earlier interview with the B&FT, said banks will ensure that the facility is made available and affordable for businesses which access them.

“Not only will funds be available, but how they become available is notable; the pricing will be lower than normal pricing and the terms will be more favourable. Each bank will make their own risk assessment, but there are guidelines on the structure and we will provide data to the Bank of Ghana so that it will know we are fulfilling this pledge,” he said.

Source: B&FT Online