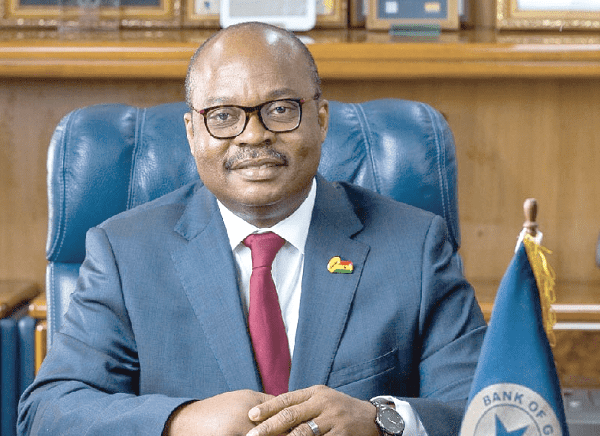

The Governor of the Bank of Ghana, Dr Ernest Addison, has called for increased partnership between BoG and stakeholders in the financial technology space to help accelerate growth.

He said the partnership should precede the creation of a robust fintech industry that would be able to take advantage of the new economy emerging from digital technology.

“Currently, there are more than 19 million active mobile money accounts driving the digital financial services industry. Prior to the outbreak of the coronavirus (COVID-19) pandemic, this number was 14.4 million.

“Similarly, mobile money interoperability continued to show strong growth of about 365 per cent in transaction volumes and 651 per cent in transaction values between 2019 and 2020.

“Collectively, therefore, we, as stakeholders, must leverage on these positive headwinds to develop and implement digital strategies to spur growth in the digital financial services sector,” Dr Addison said at the 2021 Annual Bankers Week Dinner of the Chartered Institute of Bankers last Saturday in Accra.

The dinner was held in honour of the Governor and was attended by his two deputies, Dr Maxwell Opoku-Afari and Mrs Elsie Addo Awadzi, and other players in the banking industry.

New economy

Dr Addison said globally, a new economy was emerging, built on digital technology. “From agriculture, through industry, to commerce, to name just a few, no sector has been spared the transformational power of technology.”

He explained that advanced communication technologies had linked businesses and consumers across national boundaries, breaking down the physical barriers to human interactions.

He said this new wave of change had been described in some circles as the fourth industrial revolution, characterised by the diffusion of knowledge and transfer of technology.

“In Ghana, the trends are not different. The high mobile phone penetration rate, that is the ratio of mobile subscribers to total population, has improved nationwide connectivity and resolved the challenges of distance and unfriendly terrain,” he said.

He said the availability of internet, and the flexibility and customer convenience has facilitated a vibrant online local community, which has supported electronic transactions and prompted a major shift towards e-commerce.

Dr Addison noted that currently businesses in various sectors of the economy — including restaurants, supermarkets, pharmacies, airlines and hotels — were doing a lot of online transactions.

Also, the predominantly youthful population with strong affinity towards and dexterity with digital devices is providing an added push towards Ghana’s digitisation agenda.

“The COVID-19 pandemic was challenging but it also presented some opportunities.

“As you will recall, following the restrictive measures imposed to contain the spread of the virus, BoG, in collaboration with industry stakeholders embarked on measures that encouraged the use of electronic payments,” he said.

Challenged industry

The President of the institute, Rev Patricia Sappor, observed that the banking industry continued to operate in an economy challenged by the impact of the COVID-19 pandemic.

“By the grace and mercies of God, we have been able to move on and made even bigger strides by being strong, solvent and profitable, as revealed by the KPMG Banking Sector Development Report for July 2021.

“This gives us good reasons to thank God for having brought us this far,” she added.

Source: Graphic Online