A successful public floatation of the shares of Energy Commercial Bank (ECB) will bring to GH¢1 billion, the amount raised through the Ghana Stock Exchange (GSE) this year, after three different banks raised GH¢700 million.

It will increase the number of banks floated on the GSE from the current eight to nine banks representing 30 per cent of the banks in the country.

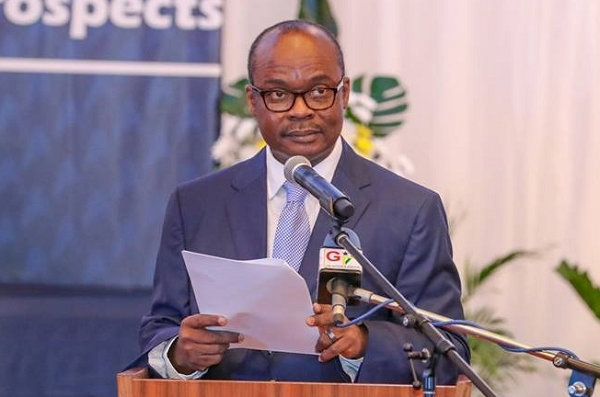

Also, should the initial public offer (IPO) issued by ECB, which is seeking to get GH¢340 million be fruitful, it would encourage other banks, the Governor of the Bank of Ghana (BoG), Dr Ernest Addison, said in a statement read on his behalf by the Deputy Head of Banking Supervision of BoG, Mr Elliot Amoako.

He urged banks that wanted to list on the GSE to harness the potential of raising long-term financing on the local bourse.

“Obviously, we still have a long way to go as we seek to get our banks listed on the local exchange,” the Governor said at the launch of ECB IPO in Accra on October 2.

As a regulator, he said the central bank would continue to assist by reviewing its processes and do away with unnecessary hindrances associated with listing on the GSE to help grow and support the vision of having a sound and a reputable capital market where institutions could source for funding.

He said the banking industry had observed in recent times that the stable macroeconomic situation in the country, notwithstanding some few challenges, had achieved a marked success in many sectors and that had guaranteed a smooth conduct of financial reform, as well as become very instrumental in the expansion of the capital market’s operations.

“Let me assure you that the financial sector reform will be expedited to ensure that we are able to transform banks into strong financial institutions which are competitive and financially viable.”

Deposit taking business

Dr Addison observed that the deposit taking business was one that was built on confidence and trust.

“As we are all aware, banks are highly leveraged institutions and as such can only be successful when lenders have full confidence that banks have the financial strength to meet its obligations as and when they fall due.”

He explained that the specialised nature of banking called for improved corporate governance structures to protect depositors and shareholders during intermediation.

Corporate governance directive

Dr Addison explained that significant efforts had been made to improve corporate governance within the system by the issuance of a corporate governance directive in March 2018.

That, he said, was to help ensure improvements in the micro infrastructure related to corporate governance which was an important step to enhance the influence of financial institutions.

“We firmly believe that the adoption of these new corporate governance directives will translate into banks enjoying access to a broad range of financing sources and at the same time lay a solid foundation for the rapid development of other financial products within the industry.

“You will all agree with me that the benefits of listing on the local bourse are immense such as elevating the market value of firms through improved transparency and integrity, liquidity, enhanced financial flexibility to reduction in cost of capital, investor protection, prestige and branding, as well as compliance with rules and regulations among others,” he said.