Global growth is expected to end this year at 4.4 per cent, the World Economic Outlook for 2022 has revealed.

This is a sharp decline from the 5.9 per cent recorded in 2021.

It reflects a half percentage point lower for 2022 than in the October World Economic Outlook (WEO), largely reflecting forecast markdowns in the two largest economies, United States of America and China.

Dubbed: “Rising Caseloads, a Disrupted Recovery, and Higher Inflation”, the release of the report yesterday by the International Monetary Fund )IMF) which was closely monitored by the Daily Graphic, indicated that a “revised assumption removing the Build Back Better fiscal policy package from the baseline, earlier withdrawal of monetary accommodation, and continued supply shortages produced a downward 1.2 percentage points revision for the United States”.

In China, pandemic-induced disruptions related to the zero-tolerance COVID-19 policy and protracted financial stress among property developers had induced a 0.8 percentage point downgrade.

Based on the forging, it further projected that global growth was expected to slow to 3.8 per cent in 2023.

According to the outlook report : “Although this is 0.2 percentage point higher than in the previous forecast, the upgrade largely reflects a mechanical pickup after current drags on growth dissipate in the second half of 2022.

“The forecast is conditional on adverse health outcomes declining to low levels in most countries by end-2022, assuming vaccination rates improve worldwide and therapies become more effective”.

Inflationary pressures

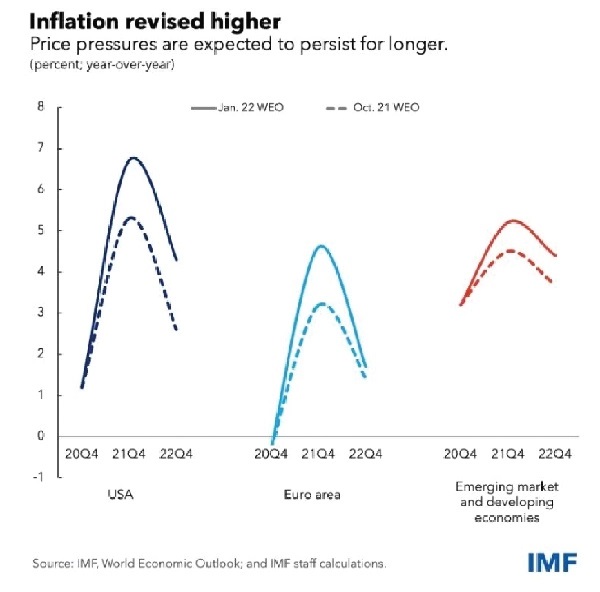

It said elevated inflation was expected to persist for longer than envisioned in the October WEO, with ongoing supply chain disruptions and high energy prices continuing in 2022.

According to the report, assuming inflation expectations stayed well anchored, inflation should gradually decrease as supply-demand imbalances waned in 2022 and monetary policy in major economies responded.

International disruptions

It said risks to the global baseline were tilted to the downside adding that: “The emergence of new COVID-19 variants could prolong the pandemic and induce renewed economic disruptions.

“Moreover, supply chain disruptions, energy price volatility, and localised wage pressures mean uncertainty around inflation and policy paths is high.”

It further noted that as advanced economies lifted policy rates, risks to financial stability and emerging market and developing economies’ capital flows, currencies, and fiscal positions—especially with debt levels having increased significantly in the past two years—might emerge.

Other global risks, kit said might crystallise as geopolitical tensions remained high, and the ongoing climate emergency meant that the probability of major natural disasters remained elevated.

COVID-19 impact

“With the pandemic continuing to maintain its grip, the emphasis on an effective global health strategy is more salient than ever.

Worldwide access to vaccines, tests, and treatments is essential to reduce the risk of further dangerous COVID-19 variants. This requires increased production of supplies, as well as better in-country delivery systems and fairer international distribution”.

Monetary policy tightening

The report noted that monetary policy in many countries would need to continue on a tightening path to curb inflation pressures, while fiscal policy—operating with more limited space than earlier in the pandemic—would need to prioritise health and social spending while focusing support on the worst affected.

In this context, international cooperation will be essential to preserve access to liquidity and expedite orderly debt restructurings where needed.

It said investing in climate policies remained imperative to reduce the risk of catastrophic climate change.

Source: Graphic Online