With global crude oil prices remaining elevated and their pass-through effects on ex-pump petroleum prices, utilities and transport, consumer inflation continued its upward ascent as cost-push factors continue to bite.

Data from the Ghana Statistical Service (GSS) show that consumer prices in the country have risen to their highest level in 5 years, as headline inflation surged to 15.7 percent in February 2022 from 13.9 in January 2021 – which is 1.8 percentage points higher than the previous month.

The GSS further revealed that three divisions – housing, water, electricity, gas and other fuels, transport and food and non-alcoholic beverages – recorded inflation rates above the national average of 15.7 percent.

Housing and water recorded 25.4 percent while electricity and gas hit 21 percent, with transport recording 18.3 percent. These factors had more far-reaching consequences on other divisions of the inflation basket.

During the month, food inflation was at 17.4 percent higher than both last month’s 13.7 percent and the average of the previous 12 months 10.8 percent. Food inflation’s contribution to total inflation increased from 44.2 percent in January 2022 to 49.4 percent in February 2022.

This gloomy inflation outlook comes ahead of the 105th regular meeting of the Monetary Policy Committee (MPC) of the Bank of Ghana that is expected to take place from Wednesday, March 23-25, 2022 to review developments in the economy – of which inflation will be a key point of discussion.

Monetary Policy

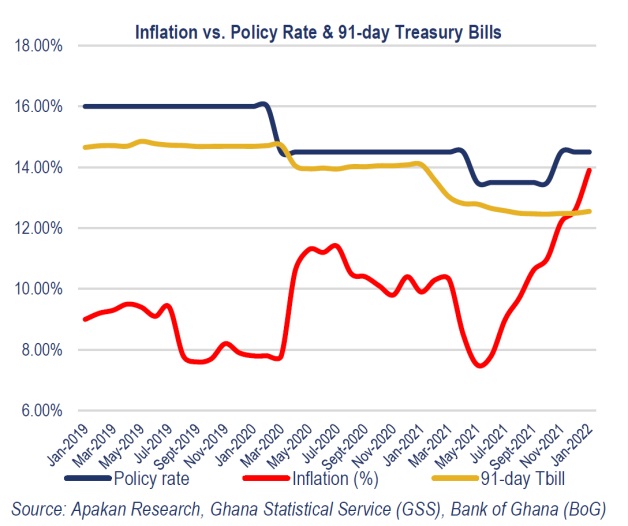

In light of heightened risks in the macroeconomic environment, including the recent rating agencies’ downgrades, significant inflationary headwinds and FX pressures, as well as increased financing requirements by the Treasury and elevated global inflation, market analysts have leaned toward a policy rate tightening.

This should be in line with monetary policy decisions in emerging markets and developing economies (EMDEs).

“We lean toward a hike of at least 100bps during the next meeting of the Monetary Policy Committee. The impending US Fed rate hikes also support monetary tightening to limit portfolio outflows and keep the currency in check,” Apakan Securities Limited said in its inflation update in February.

Additionally, the nominal policy rate at 14.5 percent and inflation at 15.7 percent denote negative real returns when compared to the average yield on the benchmark 91-day Treasury bill at around 12.6 percent.

Accordingly, the market foresees further upside to yields on the primary and secondary markets as investors will re-adjust their yield expectations higher. This should lead to a jump in yields, especially at the front end of the curve in the coming sessions.

Source: www.thebftonline.com