Government will not introduce any new taxes in the 2020 fiscal year.

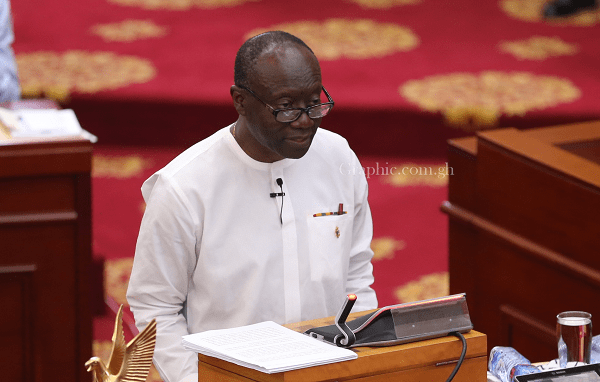

Presenting the 2020 Budget to Parliament on Wednesday, the Minister of Finance, Ken Ofori-Atta, said government would restructure the tax system and develop a comprehensive revenue policy and strategy to address the challenges of revenue mobilization.

He said government would also lend the necessary support to the Ghana Revenue Authority to boost revenue collection in order to meet its revenue targets.

“We will take radical policy and institutional reforms towards raising our tax-to-GDP ratio over the medium term from under 13 percent currently to around 20 percent. The focus will be on efficiency and base-broadening rather than imposing new taxes on our people and businesses. This way, we can raise our domestic contribution to our ambitious transformation agenda, in line with the Ghana Beyond Aid vision,” he said

“Mr. Speaker as you can see, we have not imposed any new taxes,” he added.

Mr Ofori-Atta noted however that although the Communications Service Tax was recently increased from 6% to 9%, the overall direction regarding the burden of taxation on Ghanaians has been overwhelmingly downward in the last three years.

“We promised to move the economic policy away from one focused on taxation to one focused on production and we have done just that over the last three year,” he said.

He added that in line with government’s policy, parliamentary approval would be sought to ensure that the 12 percent minimum wage increase for 2020 is tax-exempt.

“Personal Reliefs such as marriage relief, child education relief and old age relief which were last adjusted in 2015 will also be reviewed upwards, consistent with government commitment to support families,” he said.

Source: Graphic Online