Private sector credit growth is beginning to gain momentum stemming from improved liquidity position of the banks on the back of recapitalization exercise, the Bank of Ghana (BoG) has indicated.

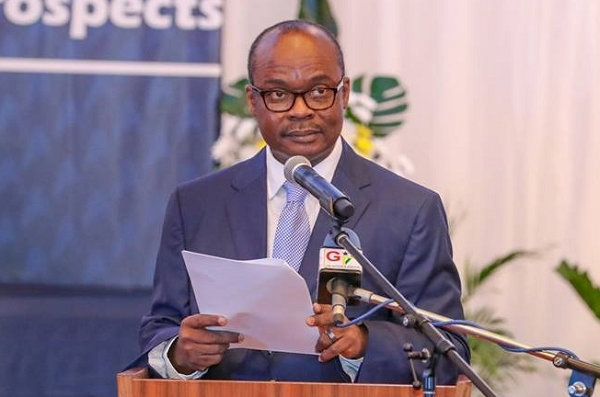

Addressing the media after the Monetary Policy Meeting (MPC) yesterday, the Governor of BoG, Dr. Ernest Addison, said annual growth in private sector credit was 21.1 percent in February 2019, compared with 2.4 percent growth in the same period in 2018.

In real terms, he said private sector credit expanded by 10.9 percent.

Treasury bill

Dr. Addison also pointed to developments in the money market which generally indicated an upward trend in interest rates on the government instruments, reflecting a heavy reliance on domestic sources of financing prior to the issuance of the Eurobond.

As such, he said the 91-day Treasury bill rate moved up by 14.7 percent in February 2019 from 13.3 percent a year ago.

Similarly, the 182-day instrument increased significantly, with yields on the 7-year, 10-year and 15-year bonds inching up to 21.0, 21.1 and 21.5 percent in February 2019 from 15.5, 15.5 and 15.9 percent respectively a year ago.

The weighted average interbank lending rate, that is the rate at which commercial banks’ lend to one another, however declined to 15.6 percent in February 2019 from 18.3 percent in the same period last year, in line with the monetary policy rate.

Similarly, average lending rates of banks also declined to 27.8 percent from 29.3 percent over the same comparative periods.

Banking Sector

Giving an assessment of the banking sector, the governor said the recently recapitalized sector was profitable, liquid and solvent, which showed strong growth prospects in outlook.

“In the first two months of 2019, the banking sector posted a stronger after-tax income. Total assets stood at Ghc 108.9 billion, representing an annual growth of 14.5 percent in the year to end February 2019,” he noted.

He said the growth in total assets was funded mainly from increased deposits and equity injection from the recapitalization exercise.

He also indicated that the key financial soundness indicators of the industry has also improved, with the Capital Adequacy Ratio (CAR) at 21.7 percent in February 2019, significantly higher than the prudential requirement of 10.00 percent.

He said the improved solvency enhanced the banking sector’s capacity to deepen financial intermediation and strengthened banks’ resilience to shocks going forward.

“Also, profitability ratios improved while liquidity measures remain broadly adequate. The Non-Performing Loans (NPL) ratio has declined from 21.6 percent in February 2018 to 18. 2 percent in February 2019, signaling some moderation in the industry’s exposure to credit risk. The on-going write-off policy and strengthening of banks’ risk management practices is expected to further impact positively on the industry’s NPL going forward,” he noted.

In summary, the governor said the MPC noted that growth in the country’s economy remained strong with the current negative output gap closing but at a moderated pace.

He said the medium-term outlook for growth was strong with the preparation of new oil wells, including those of Aker Energy who has submitted a US$ 4.4 billion plan for developing an offshore field, the re-opening of operations at the Obuasi Mine and implementation of growth-oriented government initiatives.

“These are all expected to boost medium-term growth prospects,” he said

Source: Daily Graphic